The use of IoT in agriculture, home automation, and manufacturing is well known, but a very small fraction of the population is aware of the role of IoT in banking. The Internet of Things is tapping all industries as it has use cases across various industries like manufacturing, healthcare, agriculture, financial services, hospitality, and retail business.

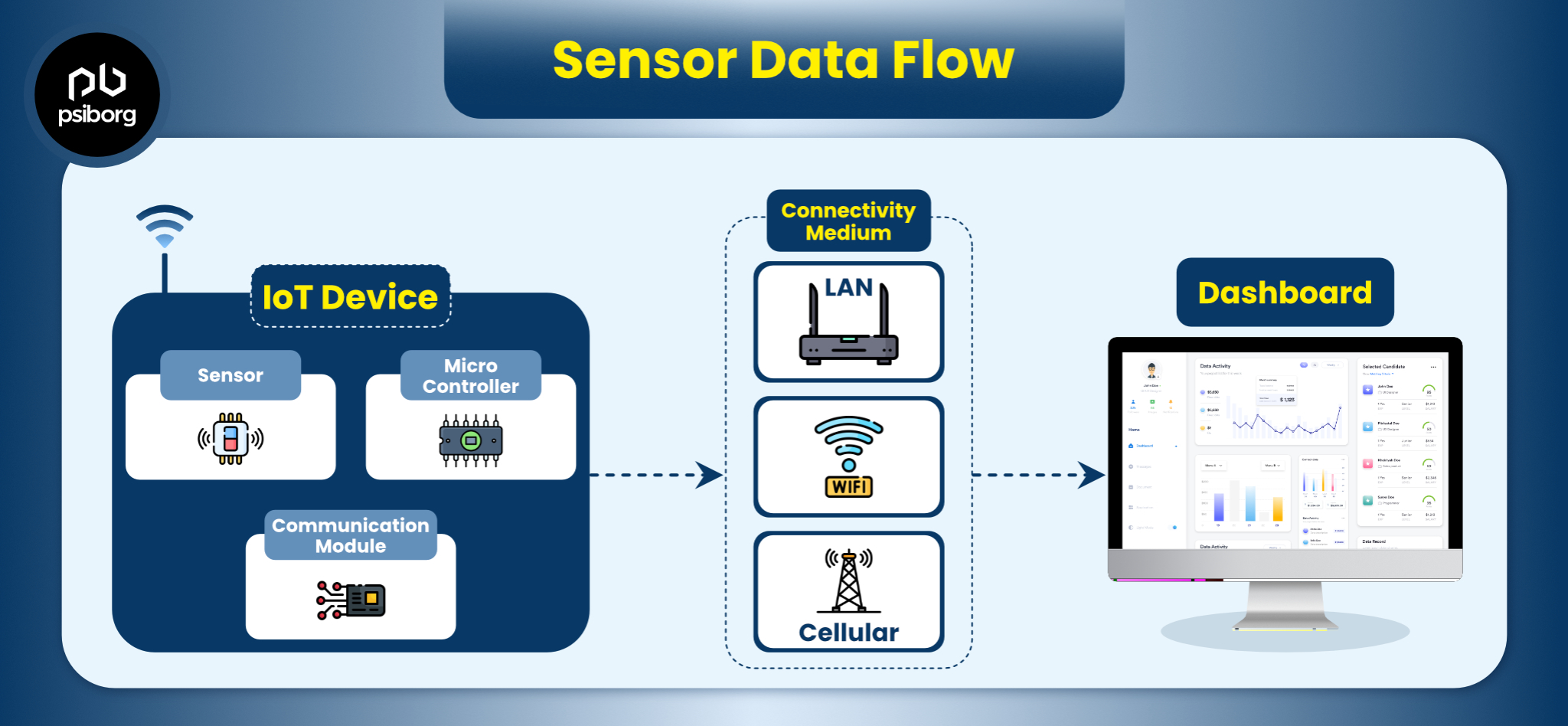

The Internet of Things is known to make things smarter and operations more time-saving by connecting our everyday objects to the Internet, allowing them to communicate with each other, share information, and conduct transactions.

Although this suite of connections and exchanges of data among devices over the internet seems very relevant in the context of finance and banking.

That is why today we are talking about the role of IoT in banking with some real-life examples.

As a little run-through, an IoT ecosystem makes tasks simpler and more efficient for banks and finance companies to digitize operations. The major progress in utilizing IoT in banking sector is the improvement in service delivery and customer experience.

Besides this, IoT technology is also helping banks and fintech firms collect and study data for accurate decision-making.

So, let’s start!

WHY IOT IN THE FINANCIAL SERVICES MARKET?

Every business is always in search of improvement and constant growth. And there’s always a trend going on in terms of technology. The Internet of Things is the current trend, and with the way this trend is advancing, it is safe to say that IoT is not only a potential future technology but also an important part of financial institutions.

Industry experts say IoT is the next big thing in the banking and financial services industry.

One report from Gartner says that IoT is much more than a distributed series of sensors and machines, as this combination of intelligent machines will transform long-standing business models.

There’s one report published by Fortune Business Insights. According to the report, the global IoT in banking, financial services, and insurance (BFSI) market is estimated to reach USD 116.27 billion by 2026, with a CAGR of 26.5%.

IoT can assist banks and financial institutions in optimizing their operations by improving present procedures and incorporating innovative strategies.

Nevertheless, fintech startups and new banks have started implementing the Internet of Things in their banking processes to offer interactive experiences to users.

USE CASES OF IOT IN BANKING

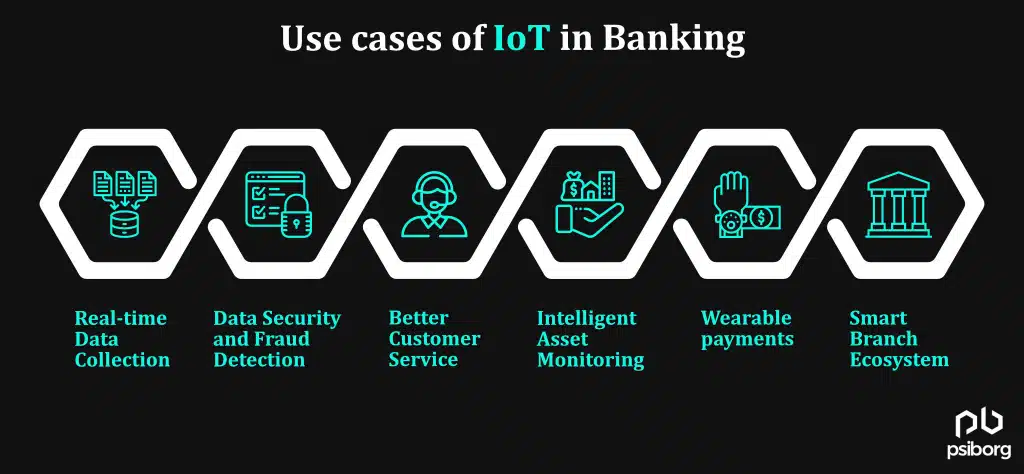

There is rapid IoT adoption in the banking and finance industries, with several use cases to optimize operations and improve the user experience. Below are some widely popular use cases of IoT in banking.

1. REAL-TIME DATA COLLECTION

IoT technology allows data collection in real time. Banks can use this feature to offer customized services and send customized notifications to customers, updating them with necessary information. Thus, helping individuals make important financial decisions.

2. DATA SECURITY AND FRAUD DETECTION

Banks and financial companies largely invest in IoT to improve security and stop fraudulent activities. With the help of IoT, the data collected from various scenarios is monitored to detect risk and mitigate a strategy to secure each customer’s account. IoT can prevent fraud by detecting unusual behavior in real time.

In addition to this, IoT technologies can also control access to customer accounts from hackers and notify customers about fake login attempts. The data provided by the IoT system gives insights into how users engage with the bank offline and online.

3. BETTER CUSTOMER SERVICE

A business, be it retail or finance, can only run successfully if it provides better customer service. So, every change and every advancement a company makes is just to improve their customer service and attract more and more customers.

IoT devices gather large amounts of data that can be used to deliver better financial services throughout the customer’s lifecycle. So, by keeping track of customers’ requirements at different times of the year, the banks can send personalized messages and reminders.

IoT is the best technology to personalize the customer’s experience.

4. INTELLIGENT ASSET MONITORING

Banks hold vast amounts of assets, and these assets need to be monitored intelligently to avoid any losses. IoT-enabled intelligent asset monitoring in banking uses connected devices to track and analyze physical and financial assets in real time. Data collected by IoT sensors allows banks and financial institutions to optimize resource allocation, reduce risks, and enhance customer experience.

5. WEARABLE PAYMENTS

By leveraging IoT technology, wearable payments enable users to make secure financial transactions using smartwatches or NFC-enabled wearables. And by connecting to a bank account or credit card, these devices allow convenient, contactless payments. Wearable payments enhance the banking and finance industry by offering customers quick, secure, and convenient ways to manage their finances and make purchases. This trend promotes financial inclusion, streamlines transactions, and increases customer satisfaction in the sector.

6. SMART BRANCH ECOSYSTEM

IoT-based smart branches are in demand among banking and finance companies. Because such smart workspaces allow businesses to provide customized customer service to everyone visiting their branch. A smart branch ecosystem includes queue monitoring, minimum waiting time, and automatically directing customers to alternate counters. In a smart branch ecosystem, the banks can also improve their workflow and reduce staff involvement by sharing real-time customer and workspace data. These days, many businesses have started using voice assistants in the IoT system to learn how customers interact with the banking environment.

Additionally, a beacon-based system will help guide customers to the nearest branch, creating comfort and convenience for them.

EXAMPLES OF IOT IN THE FINANCIAL MARKET

Organizations serving in the banking and finance industries can improve interoperability with the use of IoT. Some of the prime examples of IoT in the financial market are:

-SMART ATMS

The existing ATMs can be made more secure and convenient by deploying IoT devices. The sensors can be installed at the site to analyze critical operations like door motions, temperature, and light.

These sensors can detect unusual movements, and custom rules can be set to automate the ATM depending on different scenarios. Moreover, IoT technology can make ATM transactions convenient and safer to use.

-CONTACTLESS PAYMENTS

Banks have started employing contactless transactions, even through wearable devices. So, customers can use their smart wearables to authenticate payments. Customers can also make payments using cloud-based virtual assistants like Alexa or Google. So, with IoT voice control, transactions can be completed by using voice commands.

-SMART CONTRACTS

Smart contracts are self-executable blockchain applications that run on pre-programmed terms and conditions. These smart contracts govern transactions without any human intervention. Thus, the use of smart contracts in banking and financial institutions will allow them to streamline processes.

Plus, smart contracts will offer transparency in banking functions, which will increase customer trust. These smart contracts can also be used to process insurance claims, settle real-time payments, and automate the KYC process.

– SMART WALLETS

The integration of IoT in digital wallets is referred to as “smart wallets.” By using smart wallets, IoT devices can be used to make payments and financial transfers directly from a bank account. The use of IoT in digital wallets gives personalized features. It collects data and makes adjustments based on your habits. So, with smart wallets and IoT in banking, you can complete transactions faster.

HOW THE FINANCE INDUSTRY IS CAPITALIZING ON IOT?

– TELEMATICS

Data analytics Using IoT sensors are used to track and monitor telematics-enabled vehicles, assets, and even individuals. In the insurance industry, particularly in auto insurance, and in finance, it has a wide range of applications. Insurance companies install IoT devices in policyholders’ vehicles to collect information about driving habits, including speed, braking, and mileage. This data helps insurers assess risk more accurately, tailor insurance premiums, and offer usage-based insurance policies, ultimately reducing costs and improving customer satisfaction.

– M2M SOLUTIONS

Finance sector devices and systems are interconnected to facilitate automated data exchange without human intervention. The technology enables financial institutions to efficiently manage ATMs, point-of-sale terminals, and other banking infrastructure. The use of M2M solutions, for example, can reduce ATM downtime and operational costs by monitoring and troubleshooting them remotely. M2M connectivity also enhances the customer experience and transaction reliability by enabling secure and real-time financial transactions.

– BEACONS

A beacon is a low-cost, small IoT device that transmits signals to nearby smartphones or other compatible devices using Bluetooth technology. In the finance industry, Bluetooth beacons are primarily used for proximity marketing and location-based services. Financial institutions and banks can deploy beacons in their branches and ATMs to send personalized offers to customers’ smartphones. The purpose of this is to increase customer engagement, increase foot traffic at physical locations, and provide opportunities for cross-selling financial products and services.

FINAL THOUGHTS

The finance and banking industry is leveraging IoT technology through telematics for risk assessment, M2M solutions for efficient operations, and beacons for enhanced customer engagement and marketing.

These IoT solutions help banks and financial companies reduce costs, improve the customer experience, and, most importantly, stay competitive in a rapidly evolving digital landscape.

So, if you want to develop an IoT app or a smart IoT product in banking and finance, then look no further.

PsiBorg Technologies is a leading name in IoT service-providing companies and can offer IoT solutions to boost your operations and processes by safeguarding data.

FAQ

IoT in banking refers to the incorporation of IoT devices and technologies into banking operations to improve efficiency, security, and the customer experience. IoT works in the banking sector by connecting devices such as ATMs, POS terminals, and mobile banking apps to the Internet. These IoT devices collect and transmit data in real-time, allowing banks to monitor transactions, manage assets, and enhance security.

IoT has various use cases in the field of banking and finance, such as ATM management, where IoT sensors can monitor cash levels, and maintenance needs in ATMs for efficient cash replenishment. IoT can also create smart branches with automated check-in kiosks, improving the customer experience.

One of the use cases of integrating IoT in banking is improving the overall customer experience. IoT improves the customer experience in banking by collecting data and giving valuable insights, which will help banks offer personalized services to their customers. Other IoT-driven features like smart ATMs, smart branches, and mobile banking apps will provide convenience to customers.